Admin

Singular source of truth for singularly better experiences

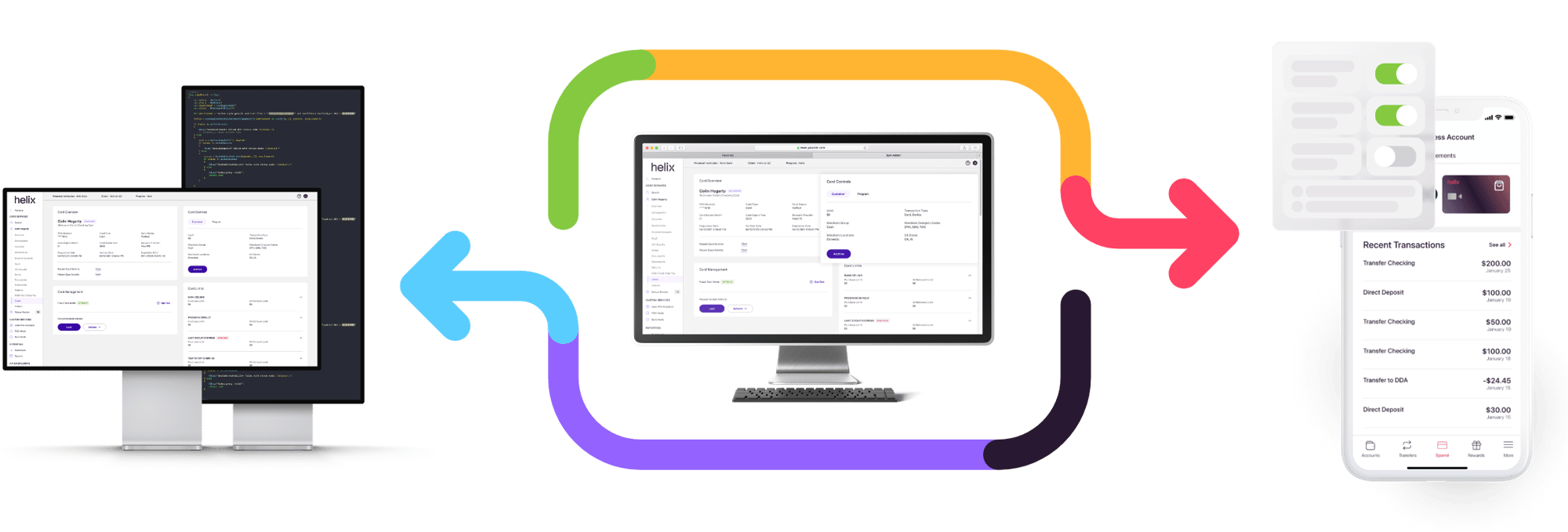

Helix Admin is the single source of truth to manage your program. When your employees and partner bank all work from the same information—updated in real-time—collaboration and customer service flourish.

Better collaboration

and support

We’ve reimagined the once-a-day, flat-file data uploads of traditional BaaS providers, which stall collaboration, heighten risk, and leave user issues unresolved.

Helix Admin operates in real-time, so handoffs are seamless, and decisions are made with context-rich data. For users, that means support teams are empowered to get to the heart of problems and quickly find resolution.

Better for employees and partners

-

Elevate collaboration

Improve synergy across internal and bank teams with access to shared information through one, real-time console.

-

Get answers quickly

Escalate regulatory issues directly to your partner bank for resolution.

-

Optimize efficiency

Access customized data controls, exception monitoring, and automated reconciliations—all in one place—for streamlined operations.

Better for users

-

Improve every interaction

Deliver customer support that delights with seamless handoff between you and your partner bank.

-

Solve problems in real-time

With rich, real-time context and powerful controls, empower customer service agents to resolve problems—even raise card limits—instantly.

-

Protect users

Use robust fraud analysis to keep your users secure without hurdles.

FEATURE HIGHLIGHT

User permission

management

Simple user permissions management ensures collaboration is always frictionless and secure.

Granular permissions let you easily set up controlled access for functions you outsource to your partner bank and other partners. Customize based on the nature of your partnerships.

Additional Features

The power behind the Helix Admin Console

Multi-Tenant Application

Multi-Tenant Application

Manage one program across multiple banks or manage multiple programs with one bank. It only takes our one multi-tenant application to meet all your needs.

Multi-Tenant Application

Manage one program across multiple banks or manage multiple programs with one bank. It only takes our one multi-tenant application to meet all your needs.

Program Management Tools

Program Management Tools

Configure daily or monthly deposit and withdrawal limits (by user or account), activate features, and customize accounts from the Admin console.

Program Management Tools

Configure daily or monthly deposit and withdrawal limits (by user or account), activate features, and customize accounts from the Admin console.