CARDS

Not just cards.

Personalized card experiences.

Cards—physical, virtual, tokenized—are the foundation of embedded banking, but realizing the full power takes more. With real-time data and controls, create personalized card experiences your competitors can't.

CARD EXPERIENCES

Customize completely.

Issue instantly.

Provision easily.

-

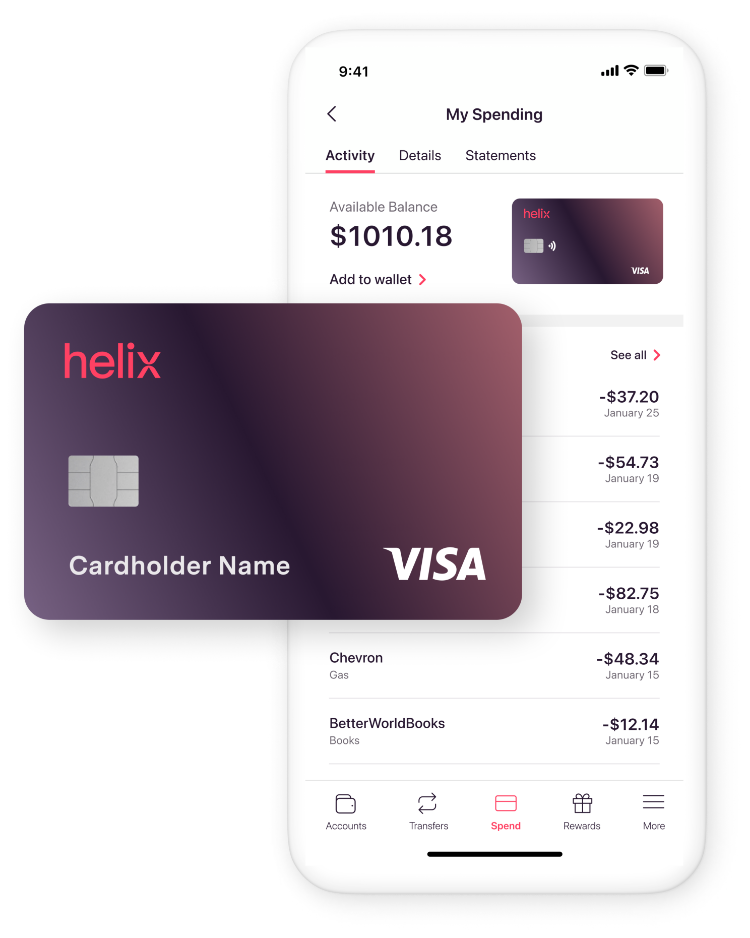

Physical Cards

Fully customize physical cards for powerful brand impact.

-

Virtual Cards

Issue and instantly fund virtual cards for immediate spending.

-

Tokenized Cards

Provision into Apple Wallet, Google Pay, and Samsung Pay for more stickiness and revenue.

PERSONALIZATION

Personalized experiences powered by data & controls

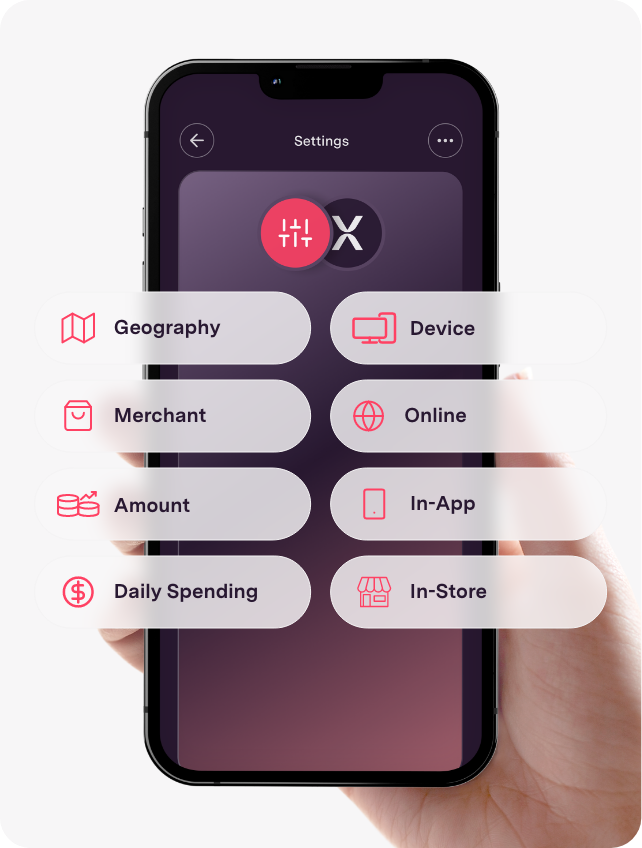

Card controls built around users

With real-time data, we help you create controls that personalize your customers' experiences—based on their criteria. Empower people to reach goals, deepen connections with your brand, and win loyalty.

Controls in action

-

Fraud controls

A U.S.-based retail brand identifies a trend in fraudulent U.K. in-store purchases. It quickly restricts U.K. users at risk, without unnecessarily affecting others.

-

Budget controls

Florida parents open a minor account for their teenager at school in Utah. They restrict card use to Florida and Utah, limit monthly spending to $200, and prohibit all in-app purchases.

-

Program risk management

Salespeople traveling to NYC are authorized to charge at food & beverage, hotel, and transportation merchants—only in NYC. Executives are exempt from restrictions.

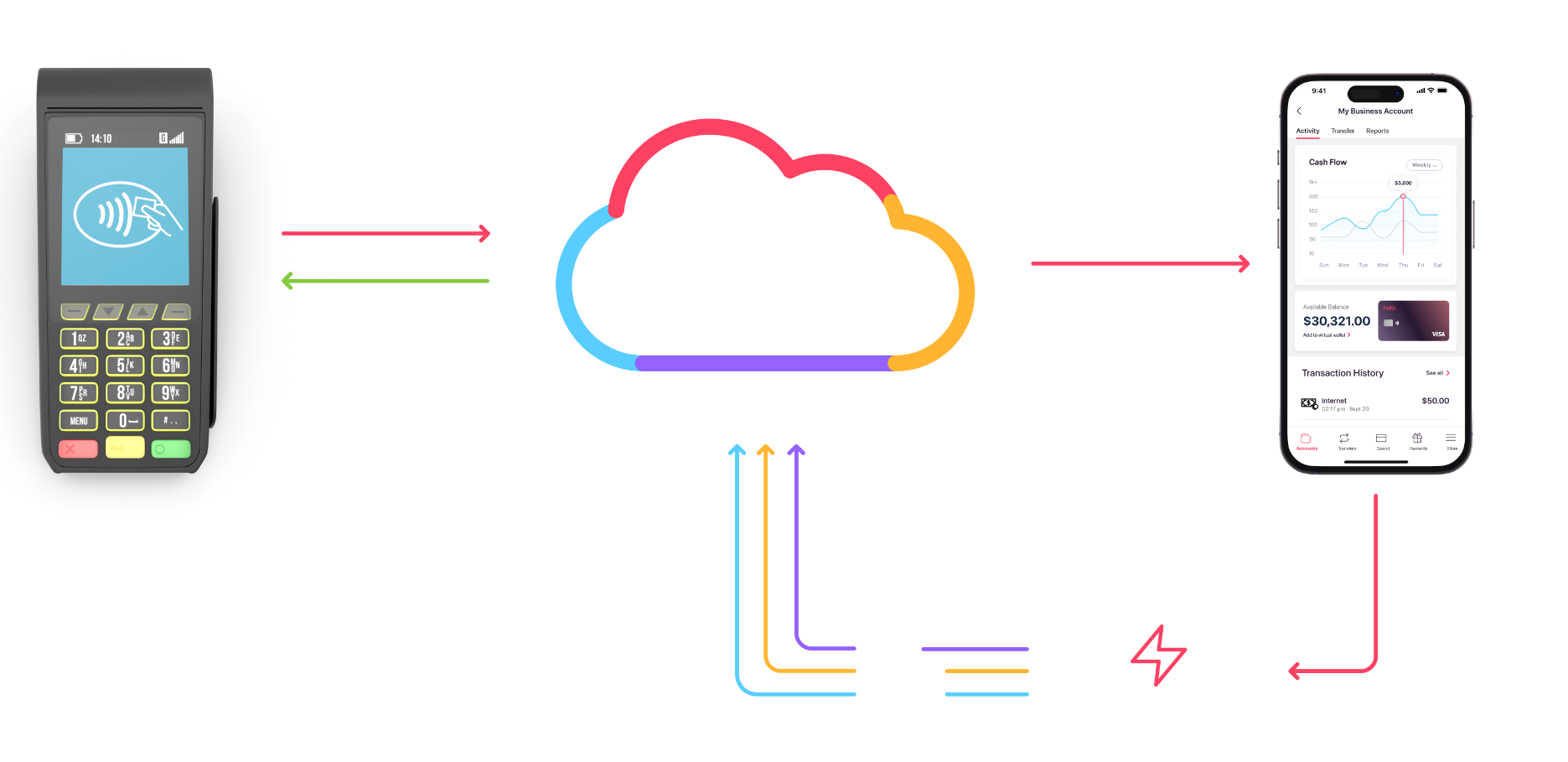

Introducing transaction-level controls

Be part of the transaction authorization decision. Use nuanced customer data to override rules, customize experiences, and mitigate risk.

-

For fraud management

You identify a fraud trend at a retail location where a segment of users regularly makes purchases. You decide if individual transactions should be approved or denied, without affecting the entire segment.

-

For personalized experience

A direct deposit customer’s debit card transaction is declined because her balance is too low. You override and approve the transaction knowing she can cover the amount with her next direct deposit.

FRAUD MANAGEMENT

Fraud management designed around you

Choose the best option for your business with the confidence that you’re protected with baseline fraud rules and risk scoring at any service level.

-

Shared Support Subscription Standard

Expert advice and support for data analysis and integration of your rules with DPS.

Built for: Brands and fintechs that need external fraud management help

-

Direct Access Pro

Direct access to the real-time DPS risk application to manage your program.

Built for: Brands and fintechs with internal resources to manage fraud

DISPUTE MANAGEMENT

Seamless dispute management

Users easily manage disputes online for quick resolution and positive experience—powered by CentrixDTS.

CentrixDTS safeguards Reg E compliance by automating provisional credits, customer correspondence, alerts, and time-sensitive actions. You save time and resources while maintaining brand trust.