Accounts and Onboarding

Banking basics for experiences far from ordinary

With user controls, Helix’s feature-rich account products—for spending, saving, and managing money—transform everyday banking into loyalty-building personalized experiences. Always PCI-compliant and FDIC-insured.

Reimagine Banking

The building blocks

Start here to create personalized experiences users can’t get anywhere else.

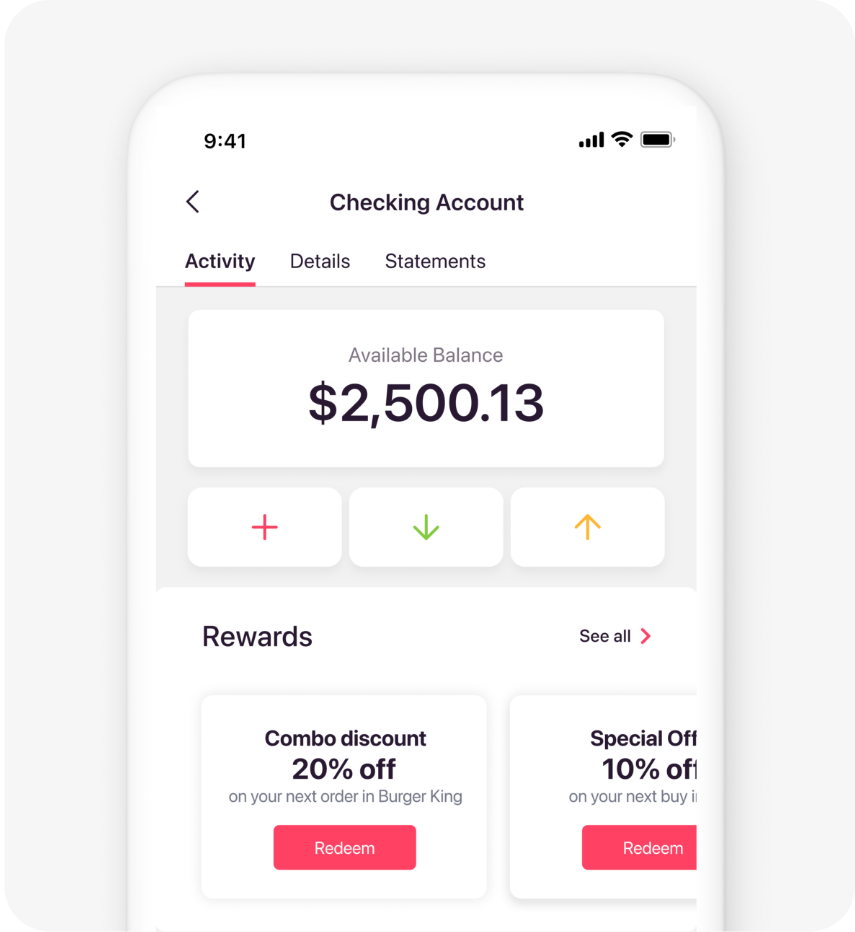

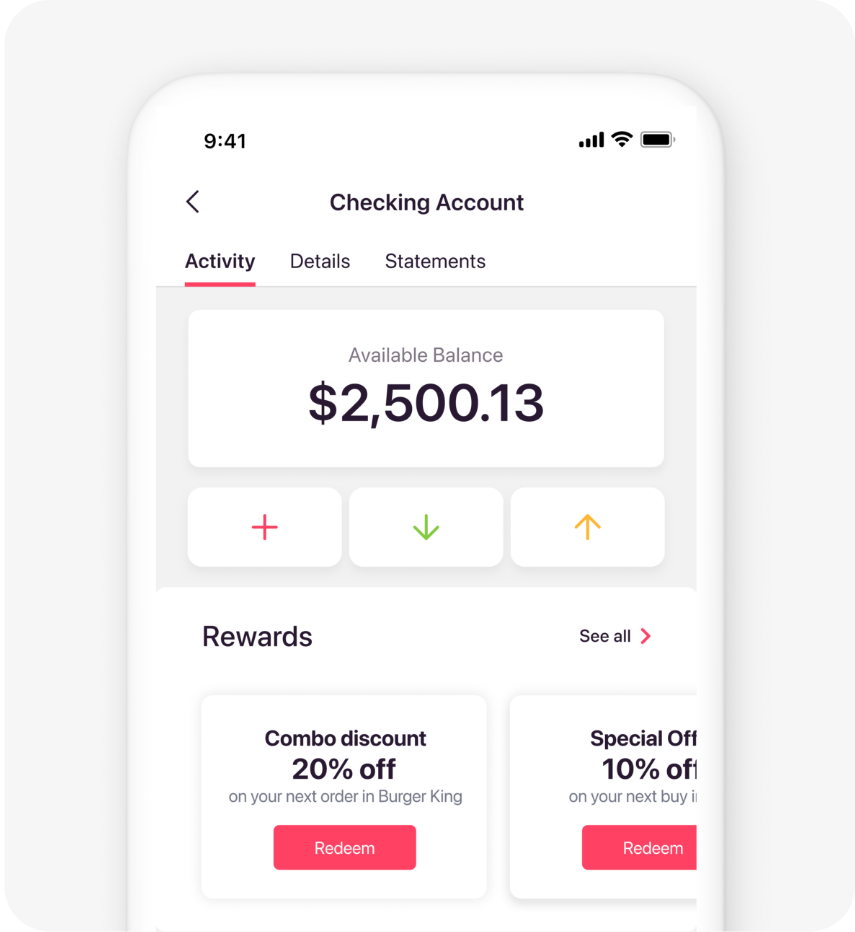

DDA Accounts

Increase brand value with the embedded, full features of a secure checking account with debit card.

- Individual and joint accounts

- Digital wallets

- Business accounts

- HSA accounts

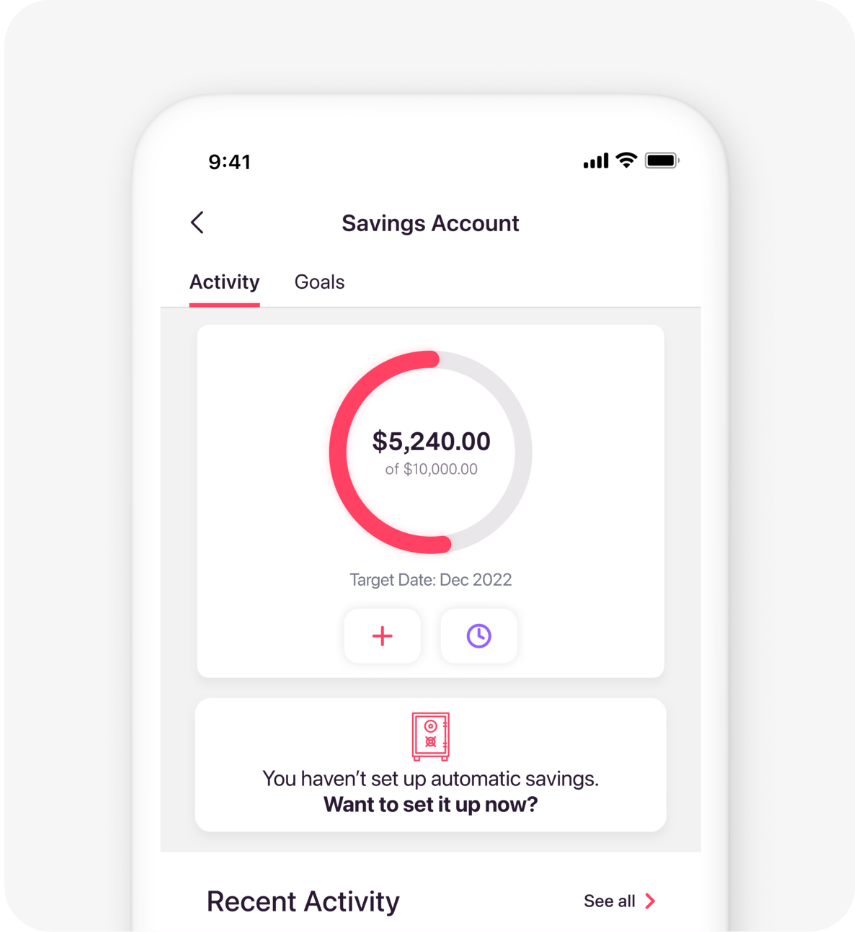

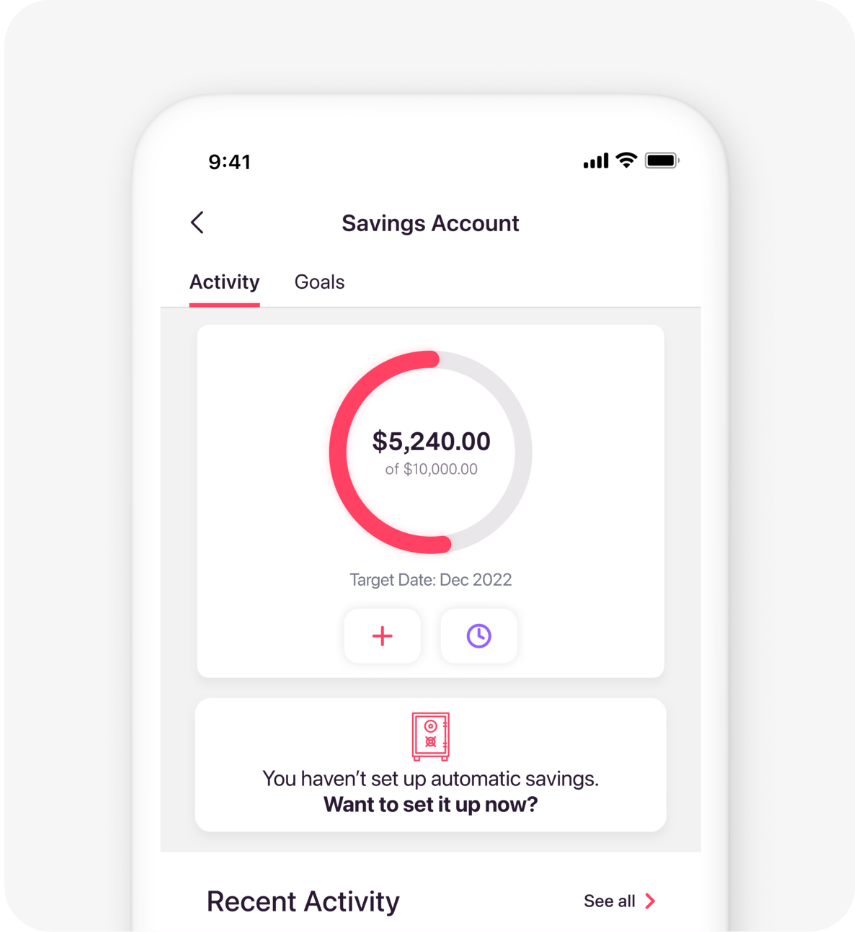

Savings Accounts

Tailor savings accounts for what matters to people, with functions that makes it easy to save for purchases, build security, and achieve goals.

- Individual, couples, and family savings accounts

- High-yield savings accounts

- Goal-based savings accounts

- Emergency savings accounts

Minor Accounts

Offer minor accounts owned by parent or guardian—with no KYC for child—to provide tools for good financial habits through hands-on spending and budgeting.

- Family savings accounts

- Allowance management accounts

- Checking accounts

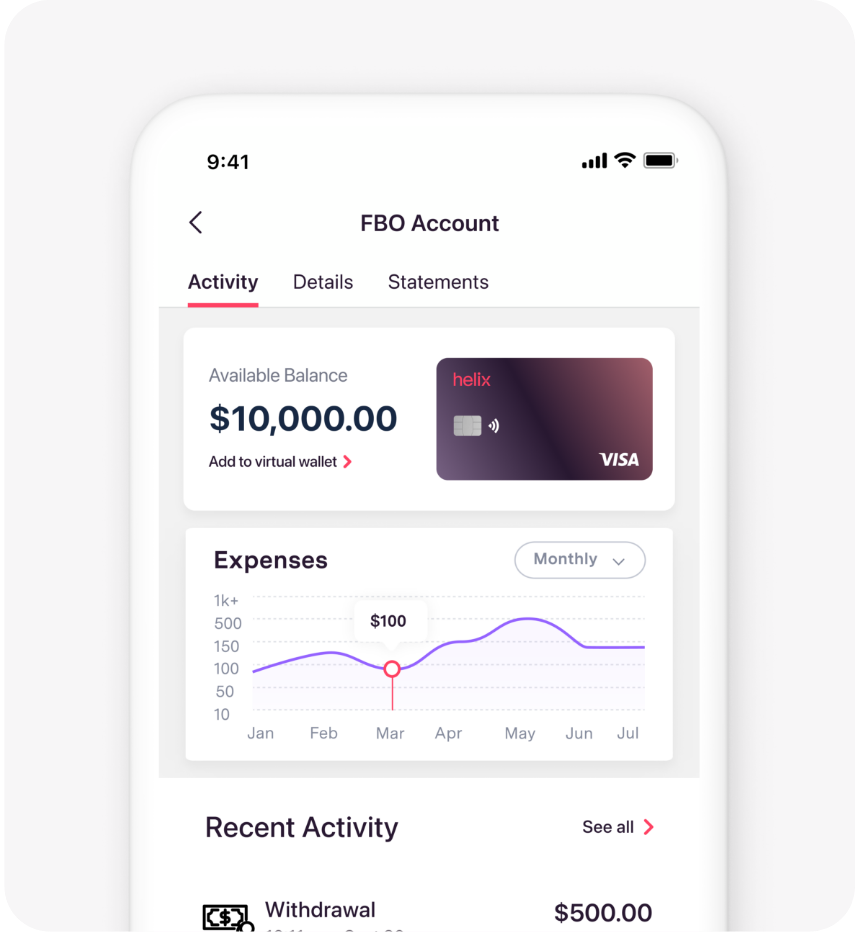

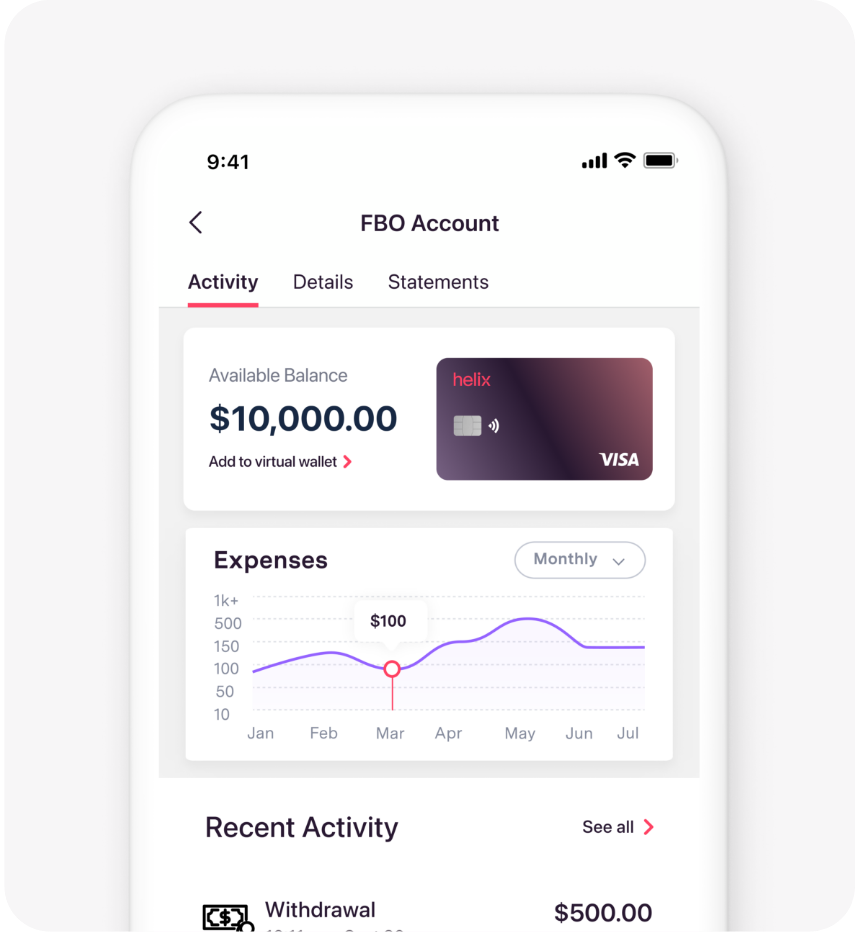

FBO Accounts

Open FBO accounts with your partner bank without KYC requirements. Personalize experiences through our unified ledger to mitigate risk.

- Escrow accounts

- Custodial accounts

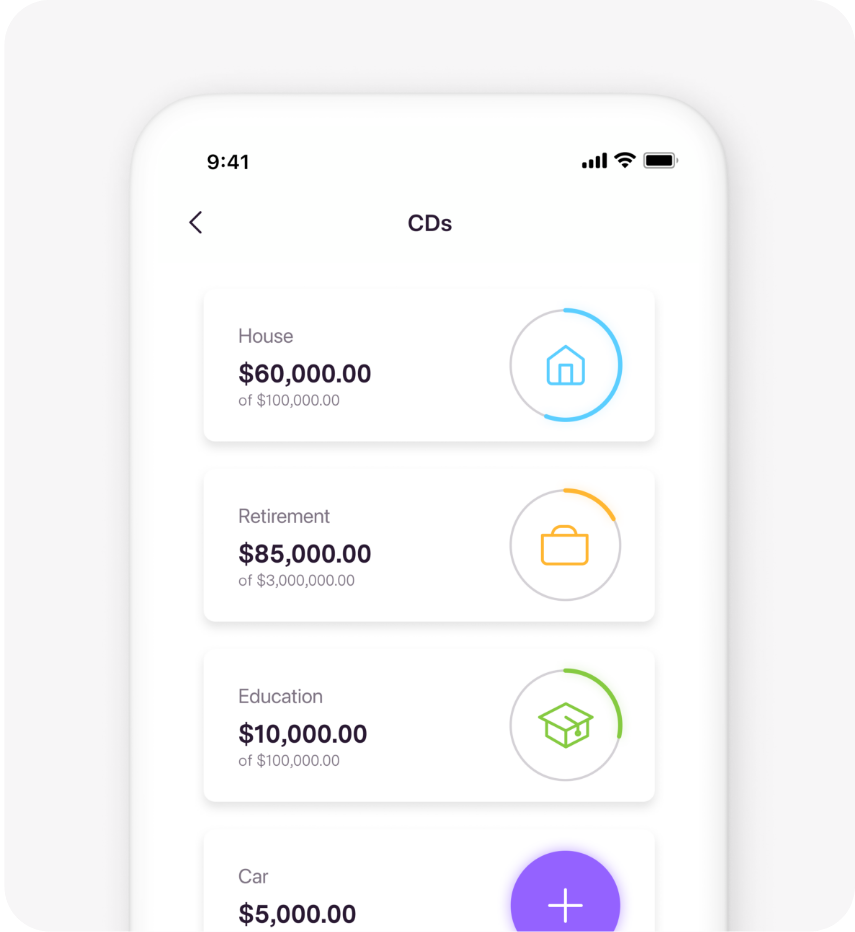

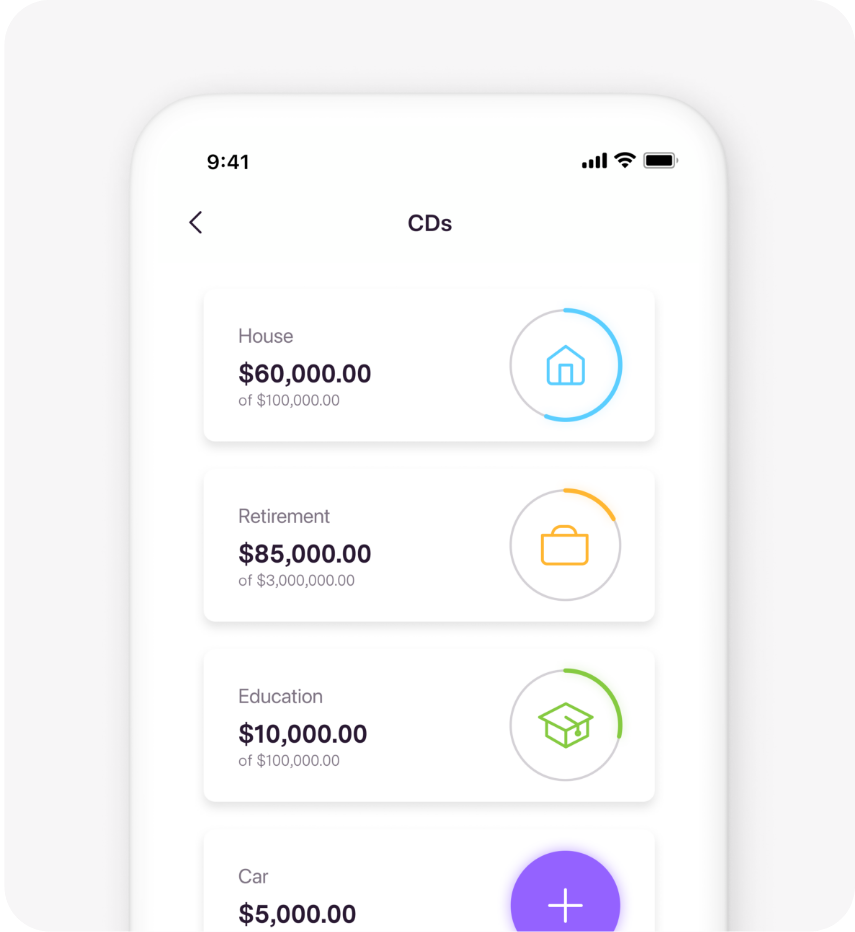

CD Accounts

Use certificates of deposit accounts to create stickiness and help users build wealth.

- Individual and joint accounts

- Rainy-day fund accounts

- Long-term savings accounts

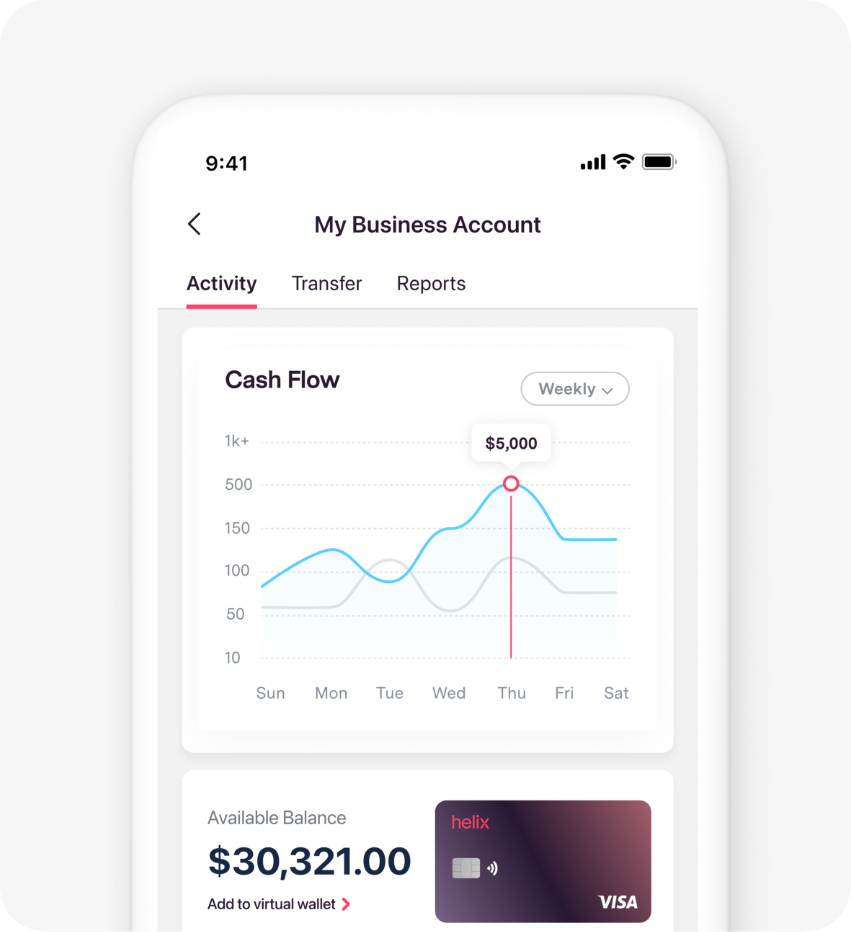

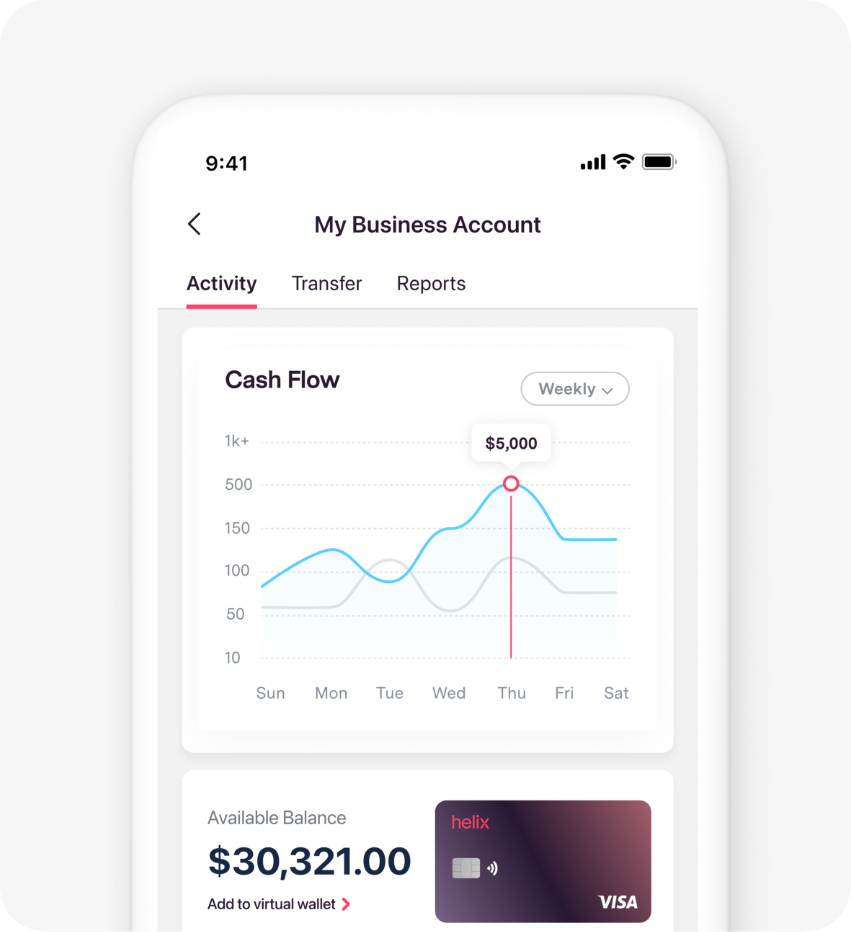

Business Accounts

Expand relationships with customers who own businesses. Offer unique experiences for creators, social media influencers, entrepreneurs, SMBs, even trusts and non-profits.

- Business checking accounts

- Business CD accounts

- Business savings accounts

- FBO accounts

DDA Accounts

Increase brand value with the embedded, full features of a secure checking account with debit card.

- Individual and joint accounts

- Digital wallets

- Business accounts

- HSA accounts

Savings Accounts

Tailor savings accounts for what matters to people, with functions that makes it easy to save for purchases, build security, and achieve goals.

- Individual, couples, and family savings accounts

- High-yield savings accounts

- Goal-based savings accounts

- Emergency savings accounts

Minor Accounts

Offer minor accounts owned by parent or guardian—with no KYC for child—to provide tools for good financial habits through hands-on spending and budgeting.

- Family savings accounts

- Allowance management accounts

- Checking accounts

FBO Accounts

Open FBO accounts with your partner bank without KYC requirements. Personalize experiences through our unified ledger to mitigate risk.

- Escrow accounts

- Custodial accounts

CD Accounts

Use certificates of deposit accounts to create stickiness and help users build wealth.

- Individual and joint accounts

- Rainy-day fund accounts

- Long-term savings accounts

Business Accounts

Expand relationships with customers who own businesses. Offer unique experiences for creators, social media influencers, entrepreneurs, SMBs, even trusts and non-profits.

- Business checking accounts

- Business CD accounts

- Business savings accounts

- FBO accounts

FEATURE HIGHLIGHTS

Beyond Basic

Solve problems, build loyalty, and grow revenue with features beyond basic.

-

Early direct deposit

Get customers their direct deposit or tax refunds two days earlier than anyone else.

-

Personalized accounts

Customize ACH transactional controls and personalize overdraft to enhance experience while controlling risk.

-

Program risk management

We charge by user, not account, so you can offer unlimited accounts to support limitless financial goals, while scaling efficiently.

-

Statements and tax

Statements and tax documents are auto-generated and sent digitally, making it easy for users and saving you money.

Plus full-featured functionality across all account types

- Access to thousands of no-fee ATMs

- Mobile check deposits

- Direct deposit

- ACH, check, wire, and P2P funding options

- Joint account options

- View-only options for non-account holders

- Real-time notifications for activity

- Real routing account numbers

EXPERIENCES

Better experiences.

Starting with the first experience.

Customized onboarding

- Custom registration workflows tailored to your users

- Pre-built integrations with KYC and KYB service providers

- No difficult out-of-wallet, knowledge-based authentication

- More auto-approvals and less fraud

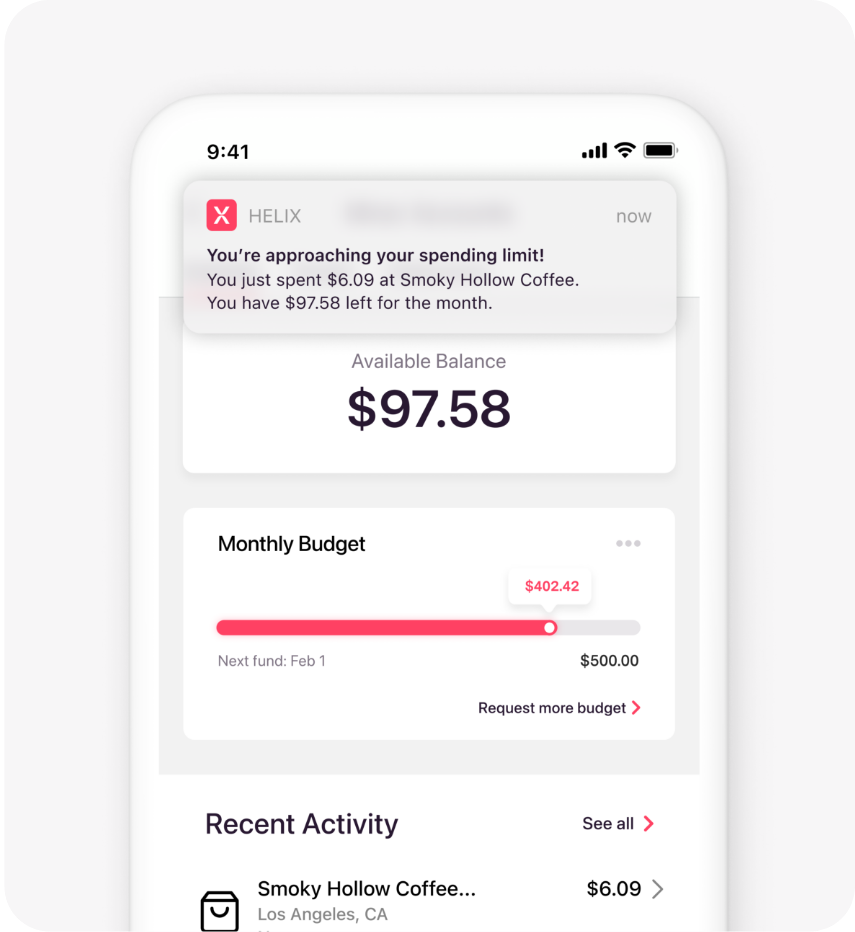

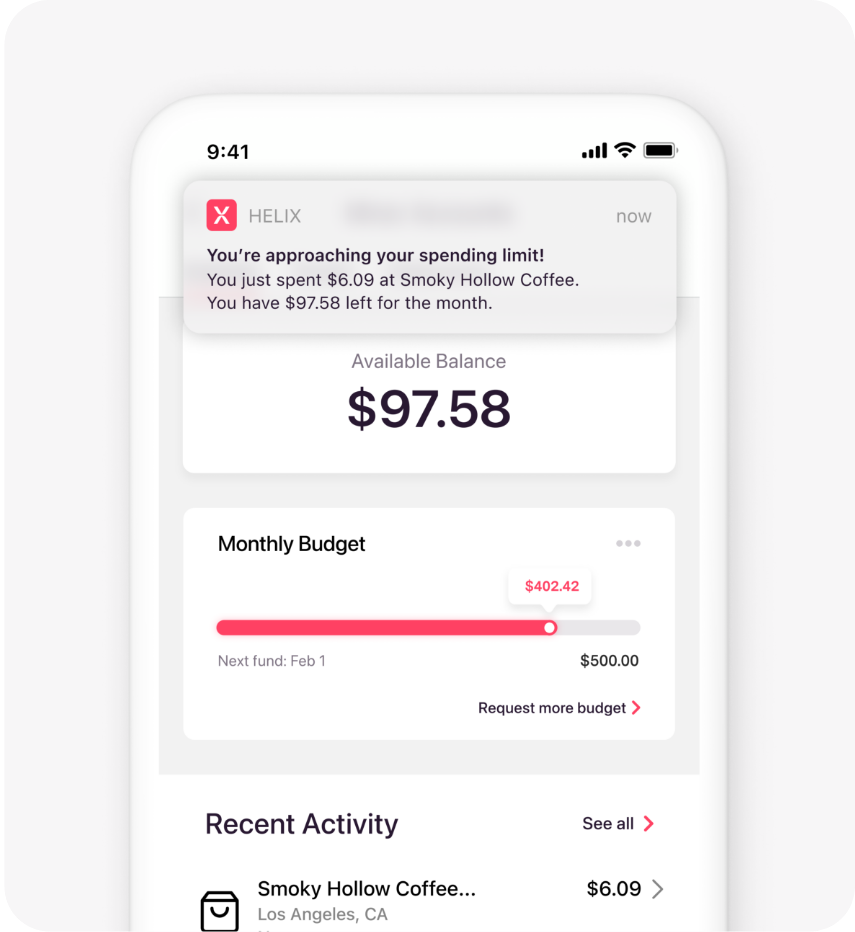

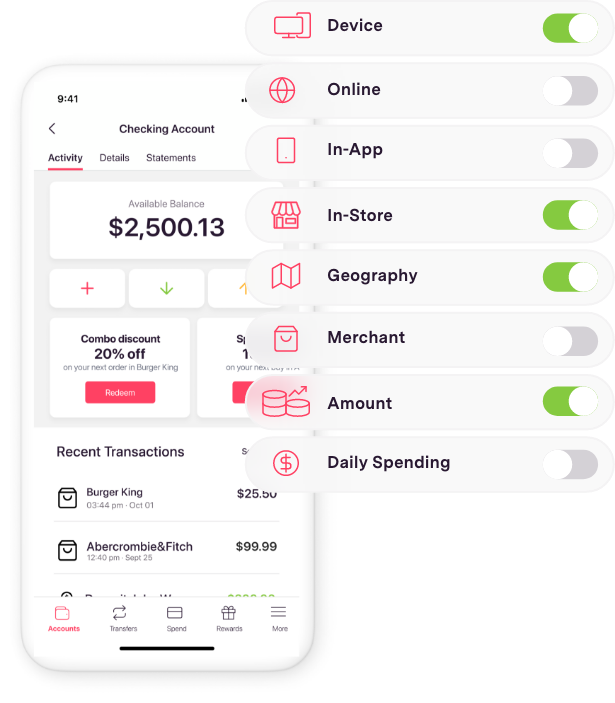

Personalized controls

- Control spending on users’ terms—from transaction type to merchant to device to geography—to achieve unlimited goals

- Limit spending authorization at program level to control fraud

- Use behavior data to incrementally expand functionality and design new products that solve more problems, keep users engaged

This is how human-centric finance works.

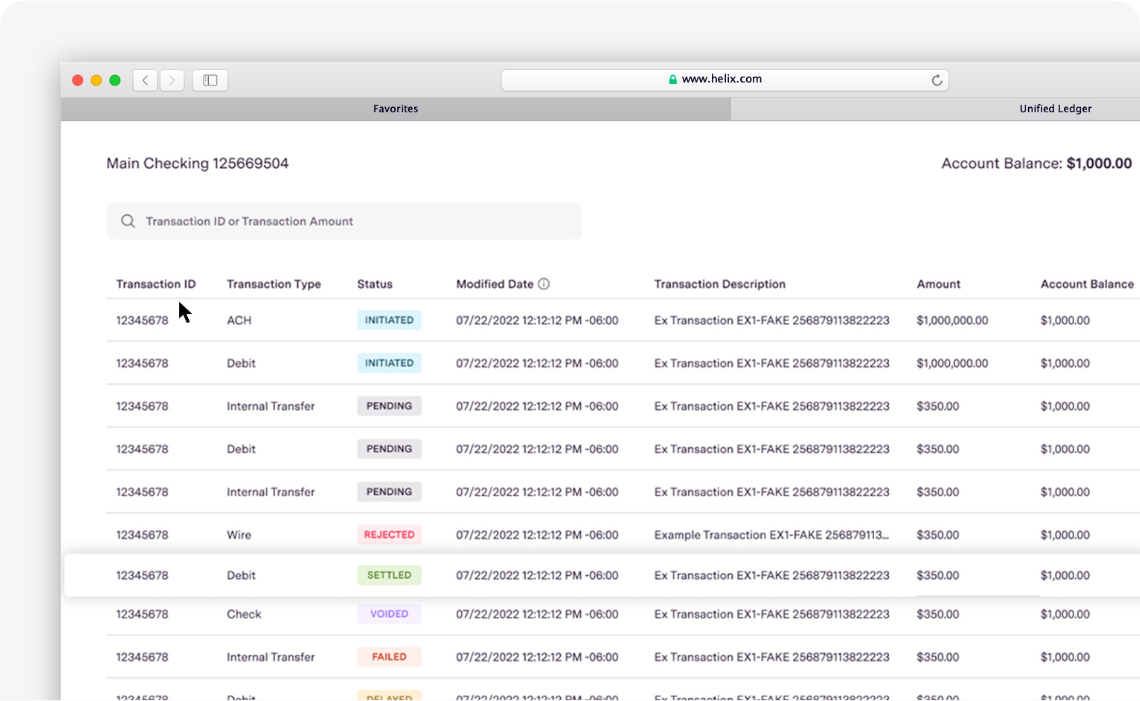

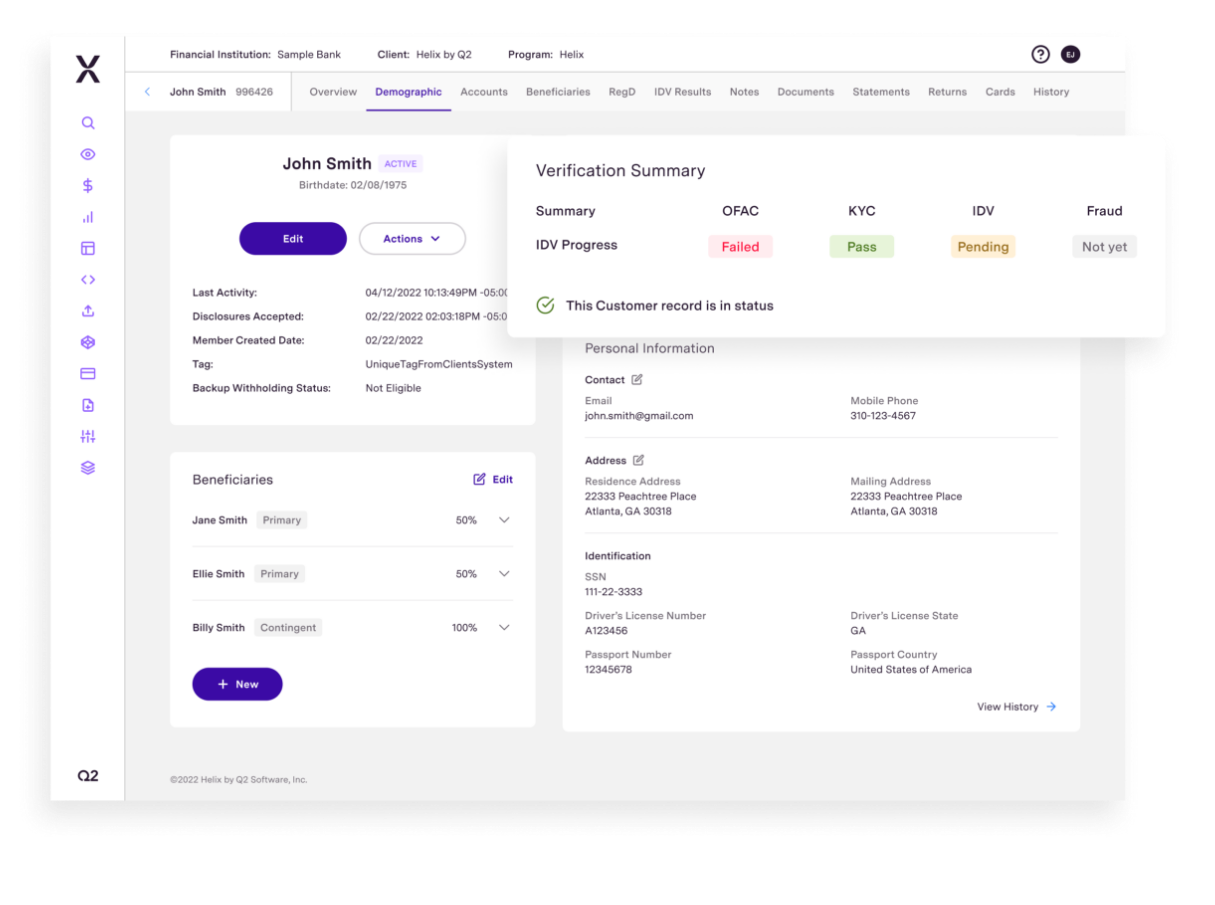

Unified, real-time ledger

Our real-time, unified ledger is your single source of truth, eliminating the pain—and regulatory risk—of disparate systems and once-a-day batch processing.

Employees, partner banks, and regulators always have access to the data they need.