Start something different

We’ve helped clients across all verticals embed banking into their business to create something brand new.

Wealth Management

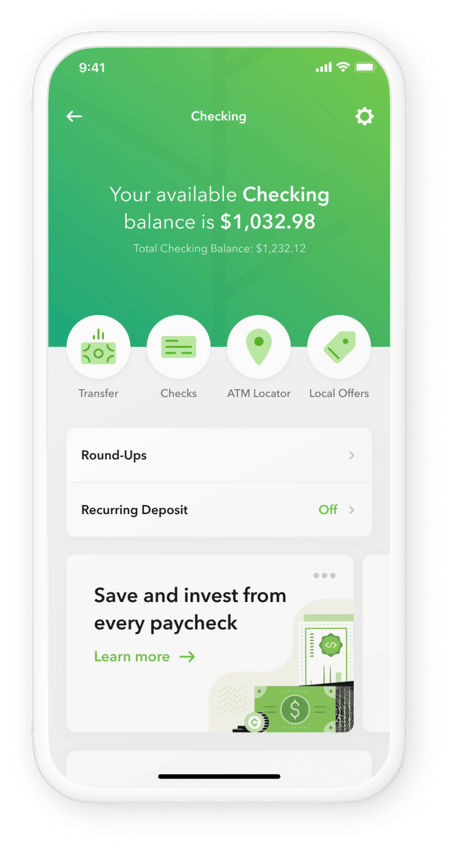

Acorns

The problem

Acorns launched the first micro-investing platform in the United States, focused on providing the underserved with greater access to wealth management services. With a goal of holistically supporting the financial wellness of their 5 million users, Acorns wanted to offer an interoperable banking solution to extend their mission of building financial confidence, wealth, and savings.

The solution

By adding an embedded bank account to their investing solution, Acorns built a seamless ecosystem to flow money between investing and savings accounts. This integrated with hero features like Roundup accounts, customized rewards, and more and came with a custom titanium debit card that users came to love. With savings, checking, investing, and retirement under one roof, Acorns has become a one stop shop for users to “grow their oak.”

“The thing that stands out about Helix is the simplicity: in the technology and integration and then in the pricing model. There’s so much inherent complexity in this landscape and Helix makes it easy to develop something great for our customers.”

Manning Field

CBO · Acorns

Manning Field

CBO · Acorns

PAYROLL

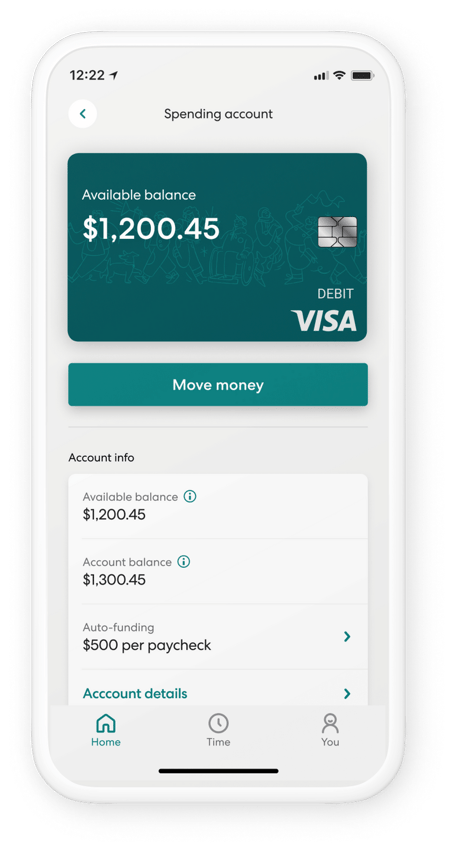

Gusto

The problem

Serving hundreds of thousands of businesses and their employees across the US, Gusto is modernizing the paycheck and creating a world where work empowers a better life. Millions of Americans live paycheck to paycheck with limited tools to help them save, spend and borrow responsibly. Gusto’s People Platform includes a suite of financial products that empower employees to build long-term financial wellness.

The solution

By embedding banking into its app, Gusto launched Gusto Wallet, a financial wellness tool for anyone paid with Gusto. Designed to tackle the cause and effect of debt and help relieve financial stress, Gusto Wallet features Cashout¹, a product allowing access to money² between paychecks and Cash Accounts³ that help employees save funds for a rainy day, earn multiple times the national savings rate⁴, and it comes with an elegant debit card that helps employees track their spending behavior.

“Helix gave us the foundation to build something unique. We didn’t want to just take something off the shelf and launch it, we wanted to think 5-10 years ahead and build with a long term partner that would help us get there over time.”

Mark Wes

GM, CONSUMER PRODUCTS · GUSTO

Mark Wes

GM, CONSUMER PRODUCTS · GUSTO

DIGITAL INVESTMENT ADVISOR

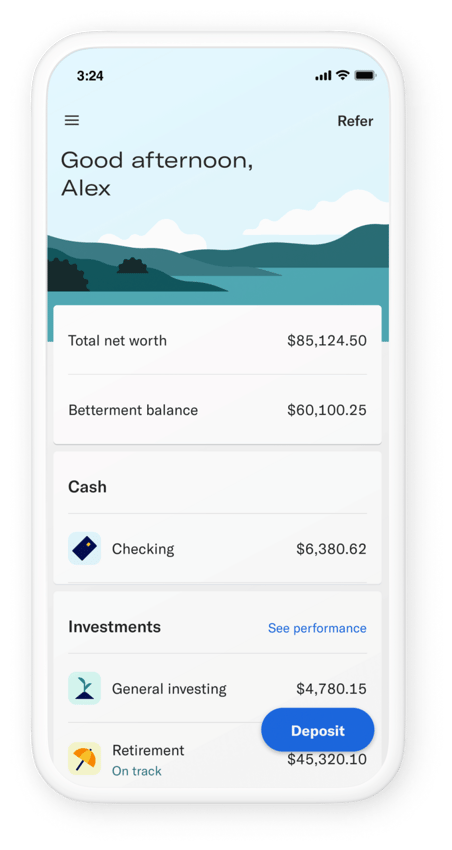

Betterment

The problem

One of the first digital investment advisors in the industry, Betterment built its business delivering customized, automated investment portfolios to its core customer base of millennial professionals. As it looked to help users with even more of their financial lives, Betterment began to explore banking as a way to continue making investing easier, better and more accessible.

The solution

Betterment Checking is Betterment’s mobile-first checking account and Visa debit card for daily spending. Betterment Checking has no fees, is safe and secure, and allows customers to earn cash back rewards. Betterment used Helix to help build a hassle-free, no-fee‡ checking account.

“Helix made it easy to integrate banking and allowed us to focus our efforts entirely on building a truly differentiated product.”

John Mileham

CTO · Betterment

John Mileham

CTO · Betterment

NEOBANK

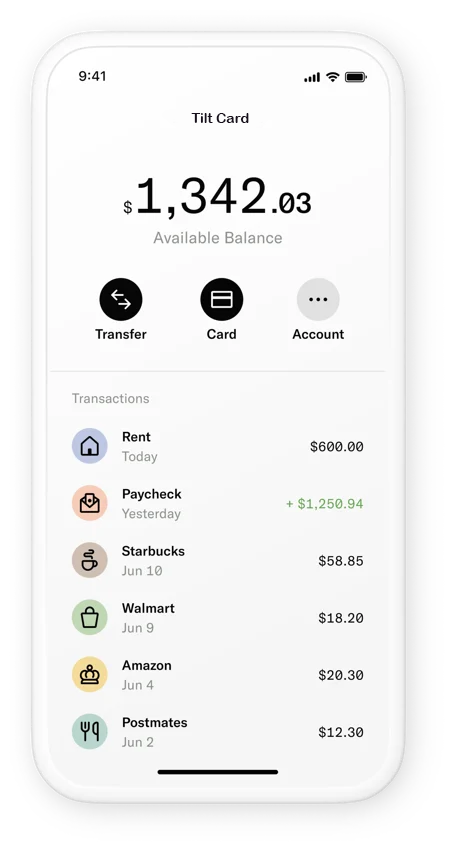

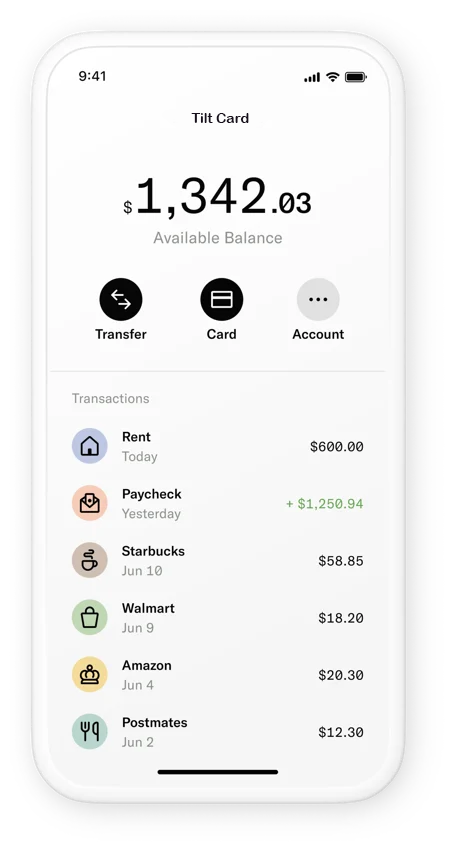

Tilt

The problem

Tilt is focused on solving access to credit for everyday Americans. In line with their mission, Tilt wanted to help customers save more money and feel less financial anxiety between paychecks.

The solution

Tilt used Helix to build out the Tilt Card and Tilt Automatic Savings experiences, enabling customers to keep more cash in their pockets. Through early paycheck deposits, instant cash advances with no interest, cashback deals on debit purchases, plus goal-based automated saving, Tilt is making it easier than ever for people to manage their money with confidence. With its modern easy-to-use suite of banking features, Tilt puts customers in control of their financial journey.

“As we continue to reimagine every aspect of the consumer banking experience, our partnership with Helix provides the framework for adding new functionality to better support our customers.”

Warren Hogarth

CEO · Tilt

Warren Hogarth

CEO · Tilt

Add-Ons

Modular add-ons to

expand your ecosystem

We’ve done the diligence and integrated the best-of-class vendors so

adding new functionality is easy and you’re future-proofed.

-

-

Data Aggregation

-

International Remittance

-

-

-

Loyalty & Rewards

-

Real-time Payments

-

-

-

Risk & Compliance

-

Tax Management

-

-

-

Investing

-

Crypto

-

SOLUTIONS

Solutions for

every use case

Lending

Lending

Lending

Instantly fund loans and earn interchange revenue

Investing

Investing

Add banking to manage your users’ portfolios

Investing

Add banking to manage your users’ portfolios

Payroll

Payroll

Pay employees more often and streamline disbursement

Payroll

Pay employees more often and streamline disbursement

Insurance

Insurance

Instantly disburse claims onto a virtual card to drive revenue

Insurance

Instantly disburse claims onto a virtual card to drive revenue

Gig-Economy

Gig-Economy

Pay gig workers more often and help manage cash flow

Gig-Economy

Pay gig workers more often and help manage cash flow

Personal Finance

Personal Finance

Personal Finance

Help users take action to improve their financial lives

Digital Banking

Digital Banking

Digital Banking

Launch a full-featured neobank or grow your offering

Loyalty & Rewards

Loyalty & Rewards

Loyalty & Rewards

Help users earn more rewards at more places to drive usage

Marketplace

Marketplace

Marketplace

Increase profit and settle funds in real-time with an in-house payment solutionDon’t just launch, stand out

We focus on helping you integrate banking into your ecosystem to build something different, not just more of the same.

Curious as to what that means?

1. The Cashout Program is issued by Sunrise Banks, N.A., Member FDIC.

2. Estimated Accrued Net Wages

3. The Gusto Cash Account, savings goals, spending account, and debit card are issued by nbkc bank, Member FDIC.

4. Savings goals Annual Percentage Yield (APY) as of 10/1/21 is 0.05%. Interest rates are variable subject to change at our discretion, at any time. No minimum balance required. Based on the FDIC national rate as of 09/20/21 available at fdic.gov/regulations/rates.

‡ Checking accounts and the Betterment Visa Debit Card provided by and issued by nbkc bank, Member FDIC. Funds deposited into Checking are FDIC-insured up to $250k for individual accounts and up to $250k per depositor for joint accounts. Betterment Checking made available through Betterment Financial LLC. Neither Betterment Financial LLC, nor any of their affiliates, is a bank. Betterment Financial LLC reimburses ATM fees and the Visa® 1% foreign transaction fee worldwide, everywhere Visa is accepted.