DATA + RISK

Fueled by data

We give you tools to turn data into insights that fuel profitability. Use what you know to personalize banking experiences and manage risk.

ALL ABOUT THE DATA

Access the power of data, your way

Real-time

-

Drive engagement

Use real-time data to increase engagement with push notifications about events like early direct depositor point-of-sale alerts.

-

Personalize transactions

Our In-Auth feature uses real-time data to empower you to override transaction decisioning based on the nuanced context you have about your user.

-

Integrate tools and technology

Enable real-time integration with third-party tools and technology like fraud engines and data platforms.

Batch

-

Build unique business logic

Use batch files for analysis across multiple systems, enabling data-driven logic for functions like automatic ATM rebates and card rewards.

-

Understand and control fraud trends

Trend-based fraud monitoring—enhanced with machine learning—allows you to identify and stop fraud with user- or program-level controls.

-

Track success with program metrics

Analyze usage—token status, balances, direct deposit—to understand program health and make changes to drive adoption, engagement, and revenue.

THE POWER OF DATA

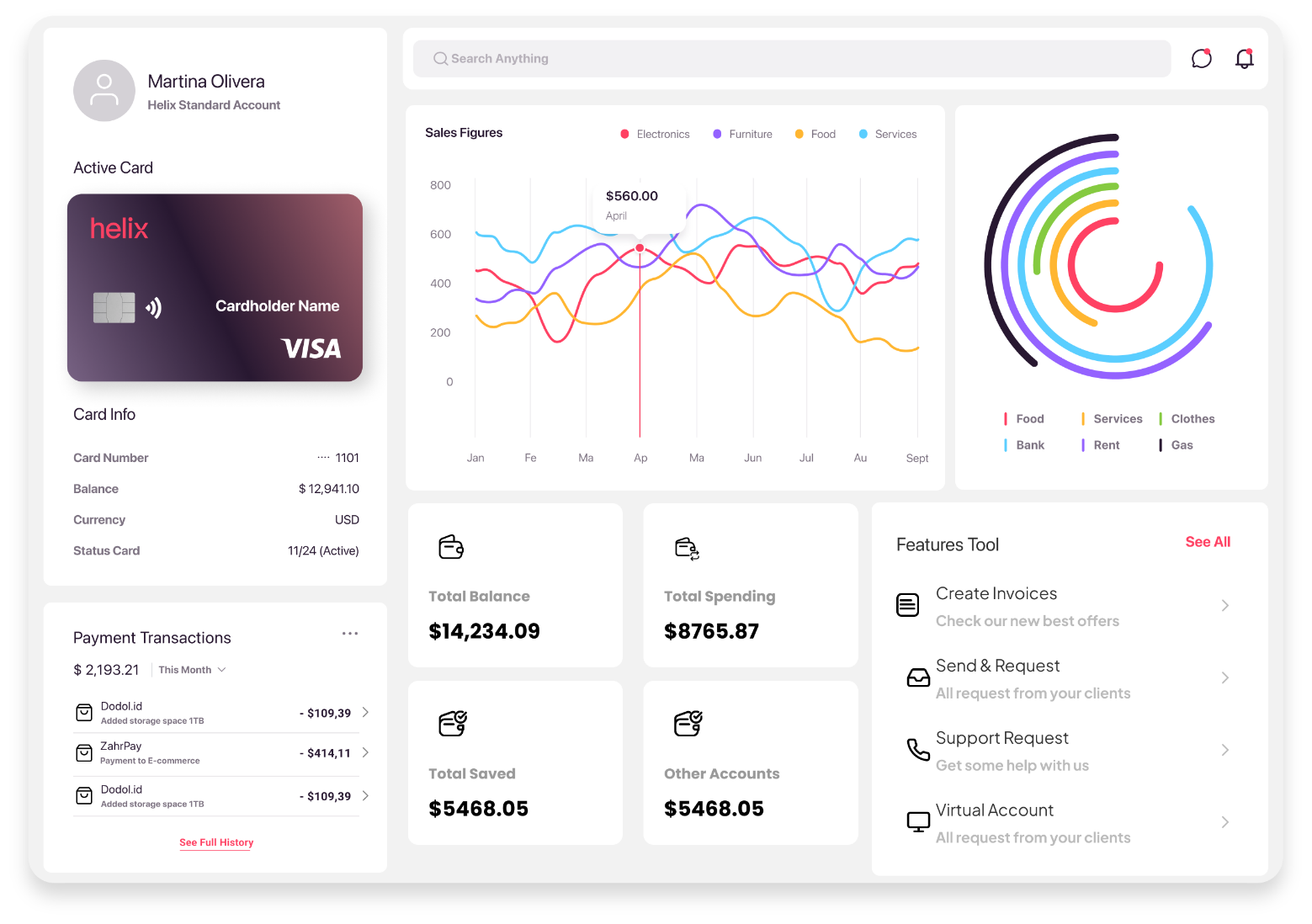

Custom analytics and reporting

Custom reporting made simple

Turn raw data into business intelligence with analysis of:

- Fraud trends

- Spending patterns at the program, segment, and user level

- User behavior

- Program metrics

- Transaction and settlement data for compliance reporting

Use case

Test the performance of a rewards campaign with a small segment. Analyze the behavior and transactions of the test group from reports, then use insights learned to refine and optimize a campaign to a larger segment.

DATA-DRIVEN CONTROLS

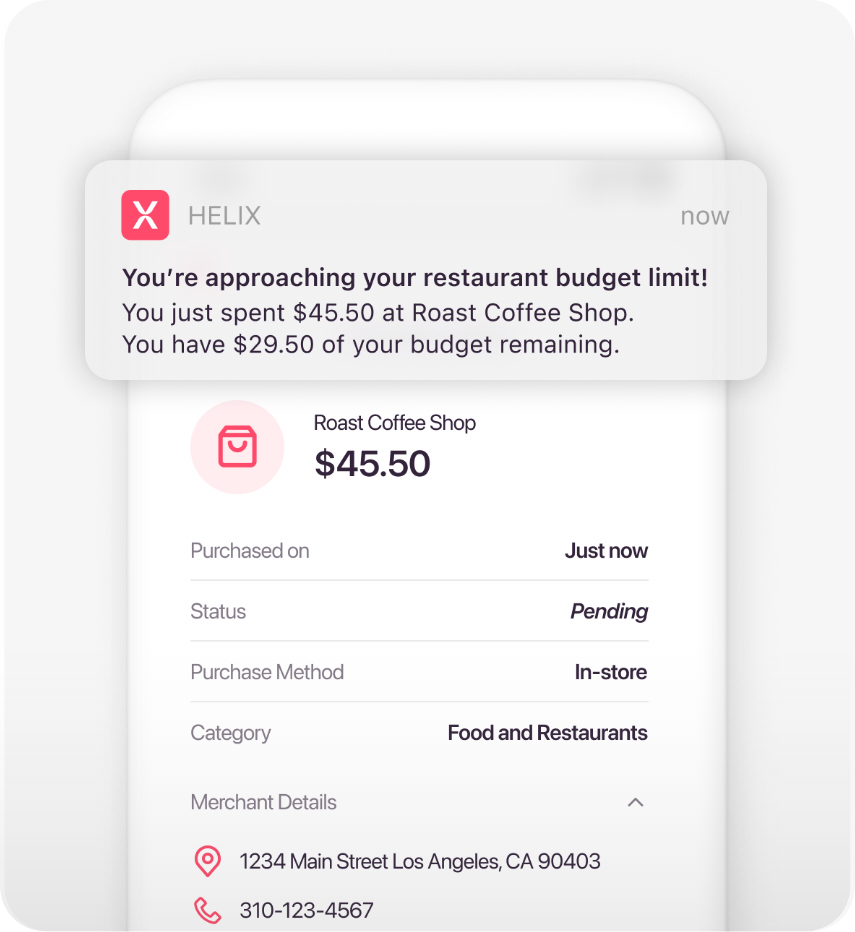

Data + Controls = Unique Experiences

Here’s how it works:

|

For a user saving for a first-home purchase, customized controls limit monthly restaurant spending to $400. |

|

With real-time data, you know when she is within $25 of her limit. |

|

With that real-time information, you send an alert through your app and ask if she wants to increase the limit. |

|

She chooses to keep or raise the limit. |

|

The experience increases engagement and builds loyalty because you’ve helped her get closer to her goals—on her terms. |

DESIGNED FOR YOUR BUSINESS

Flexible fraud management services

Our two-tier model is designed to meet your needs, while always protecting you with baseline fraud rules and risk scoring.

-

Shared Support Standard

Created for: Fintechs and brands that need external fraud support

Includes: Data analysis, fraud rules, and an expert to help you understand fraud trends and prevent fraud events

-

Direct Access Pro

Created for: Fintechs and brands with internal resources to manage their own fraud experience, including data analysis and fraud rules

Includes: Direct, real-time access to Visa DPS’s robust risk application to manage your program